A closely followed macroeconomist believes that the stage is set for the Federal Reserve to start cutting interest rates sooner rather than later.

In a new video, Jeff Snider tells his 44,700 YouTube subscribers that the US economy is flashing signs of weakness and facing disruptions in the financial industry.

According to the macro expert, the collapse of Silicon Valley Bank and Credit Suisse last month is just the beginning of the financial disruptions. He also mentions that the country’s labor market is starting to show signs of slowing down after payrolls grew by 236,000 in March, which is significantly less than the 472,000 jobs created in January.

Snider says that current macro conditions will likely force the Federal Reserve to shift its focus from fighting inflation to rescuing the economy from witnessing a full-blown recession.

“The more we get of economic weakness, the more prospects for financial dysfunction. We do get a quick swing in the Fed reaction function so that rate cuts, they begin relatively soon and they can come fast and furious, which by the way, is exactly what the way our markets are pricing…

Markets are pricing for a quick shift to rate cuts, and then a rapid series of them once they happen. This is not at all out of line with economic and Federal Reserve history. In fact, it is perfectly in line with Federal Reserve history because, in that history, the Fed usually follows the markets and the economy, not the other way around.”

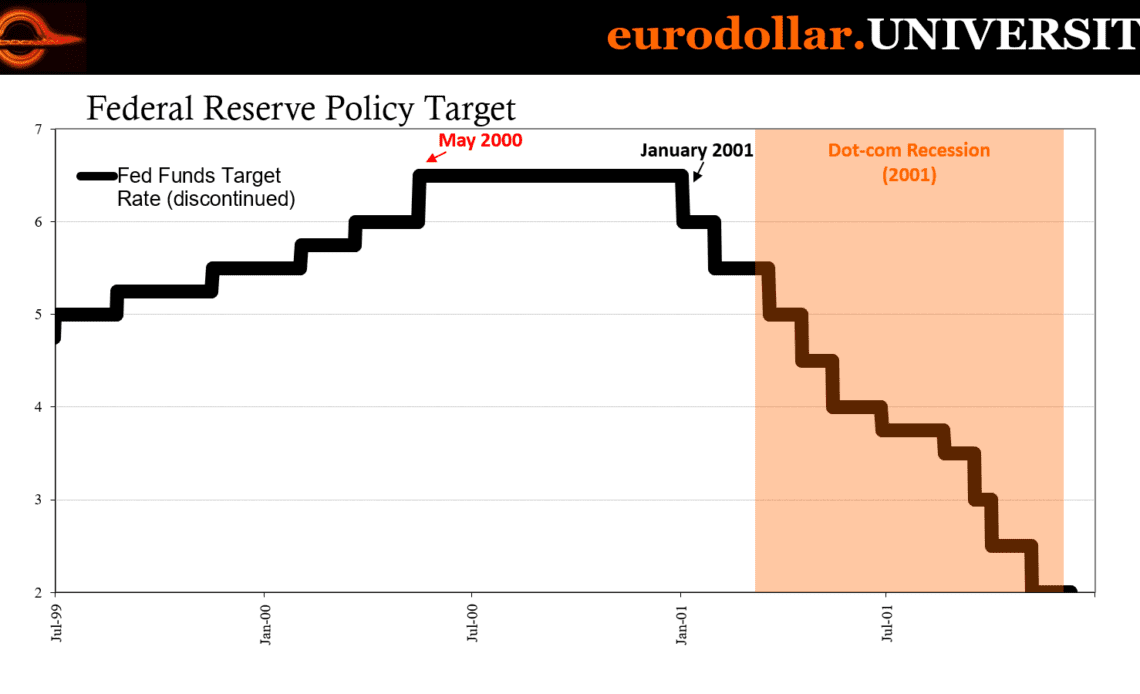

The macroeconomist recently told his 103,600 Twitter followers that the Fed has a tendency to say that it has no intention of cutting rates only to swiftly pivot “once reality hits.” Snider gave multiple examples including the Fed’s reaction in 2001 when the country saw the dot-com recession.

“In 2000, FOMC (Federal Open Market Committee) refused to consider anything but a labor shortage and inflation risks. Beginning Jan ’01, more weakness plus stock bust unleashed furious rate cuts just weeks before policymakers said were unthinkable.”

In addition to concerning macroeconomic data, Snider highlights that a number of central banks including the Reserve Bank of India, the Reserve Bank of Australia and the Bank of Canada have already hit pause on their rate hike campaigns,

“All the pieces are falling into place. And among those pieces, one of the last pieces is several central banks are already in the pause phase with I gotta believe,…

Click Here to Read the Full Original Article at The Daily Hodl…